Lithuania’s Fintech Industry in 2020: Review of This Year’s Key Developments

by Fintechnews Baltic December 23, 2020Lithuania’s fintech ecosystem continued to grow in 2020 on the back of government-led initiatives, favorable regulations, and booming digital finance activities caused by the COVID-19 pandemic.

As of Q3 2020, Lithuania is home to more than 200 fintech companies and had issued 121 licenses going towards electronic money institutions (EMIs) and payment institutions (PIs). These figures make Lithuania one of the largest fintech hubs in Europe by number of licensed companies.

The Bank of Lithuania is currently examining a total of 40 licensing applications, and in 2021, the central bank is expected to receive up to 100 new applications.

Lithuania: a gateway to the European Union (EU)

In 2020, Lithuania continued to attract foreign fintech startups, especially those from the UK looking to establish a new European outpost as Brexit looms.

Three UK fintech firms Curve, Fidelis Europe and DiPocket had set up subsidiaries in Lithuania this year to continue serving customers across mainland Europe following the end of the Brexit transition period. Curve provides a mobile banking platform, Fidelis Europe specialises in the FX industry and DiPocket provides cashless payment solutions.

Other foreign fintech startups that established a presence in Lithuania in 2020 include Juni (Sweden), Stanhope Financial (Ireland), Ria Money Transfer (USA), Saldo Finance (Finland), AML Analytics (UK), and Clearshift (USA).

Fintech shows resilience in face of COVID-19

Despite COVID-19 causing global uncertainties and economic turmoil, Lithuania’s fintech sector has remained rather resilient.

Out of the EUR 34 million raised by Lithuanian tech startups in H1 2020, EUR 14 million went towards fintech companies, showcasing that investors are still bullish on the sector’s growth potential, Jone Vaituleviciute, partner at Startup Wise Guys, said during a live webinar hosted by local fintech hub Rockit Vilnius on December 14, 2020.

If anything, COVID-19 has even accelerated fintech activities in certain segments including digital payments. Latest data from the Bank of Lithuania show that digital payment transactions executed by EMIs and PIs grew 1.6 times year-on-year to reach a total of EUR 24.9 billion in Q3 2020.

During the virtual panel discussion, Greta Ranonyte, chief strategist of the financial markets, policy department at the Lithuanian Ministry of Finance, said that during the pandemic, fintech companies played a key part in facilitating the channeling of government supported loans to SMEs and financial aid. She said COVID-19 has boosted awareness and adoption of fintech in Lithuania.

Lithuanian payment companies record strong growth

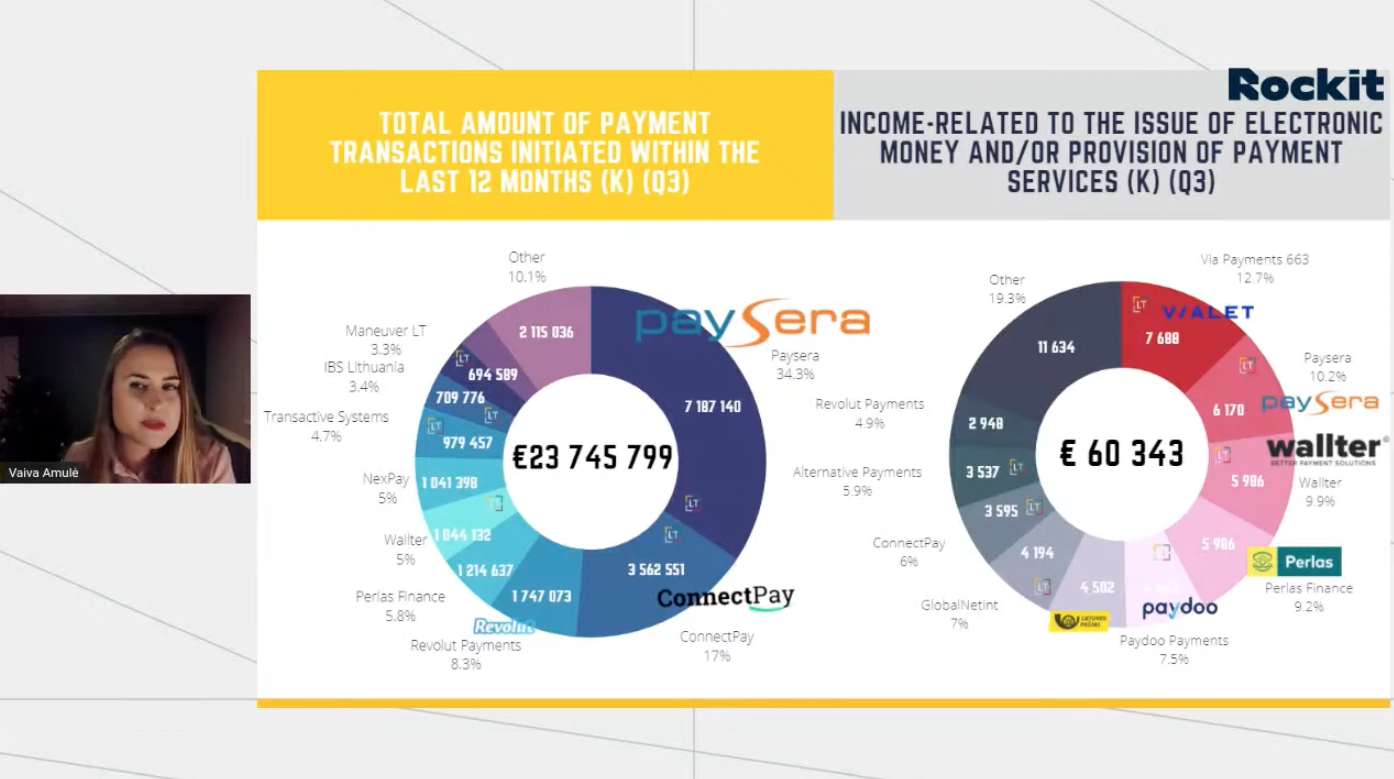

In Lithuania, Paysera continued to be the market leader this year, accounting for 34.3% of all payment transactions between Q3 2019 and Q3 2020, Vaiva Amule, head of the Fintech Hub LT association, said during the panel discussion.

Other Lithuanian payment leaders included Connect pay (17% market share), Wallter (5%), Transactive systems (4.7%), IBS Lithuania (3.4%), Maneuver LT (3.3%).

Maneuver LT, the operator of the Genome wallet, was amongst those that witnessed the strongest growth this year, with the total amount of payment transactions skyrocketing between Q2 2019 and Q2 2020. IBS Lithuania recorded a 1,784% increase in payment transactions, while for Wallter saw transaction volume grow 813%.

One notable detail with these players is that they all received their licenses within the past two years, showcasing that digital payment adoption has accelerated over the past year or so, Amule said.

Screengrab of Vaiva Amule, head of the Fintech Hub LT association, presentation for Wrap up of 2020: Fintech Scene in Lithuania, Rockit Vilnius, Youtube

National Fintech Action Plan 2020

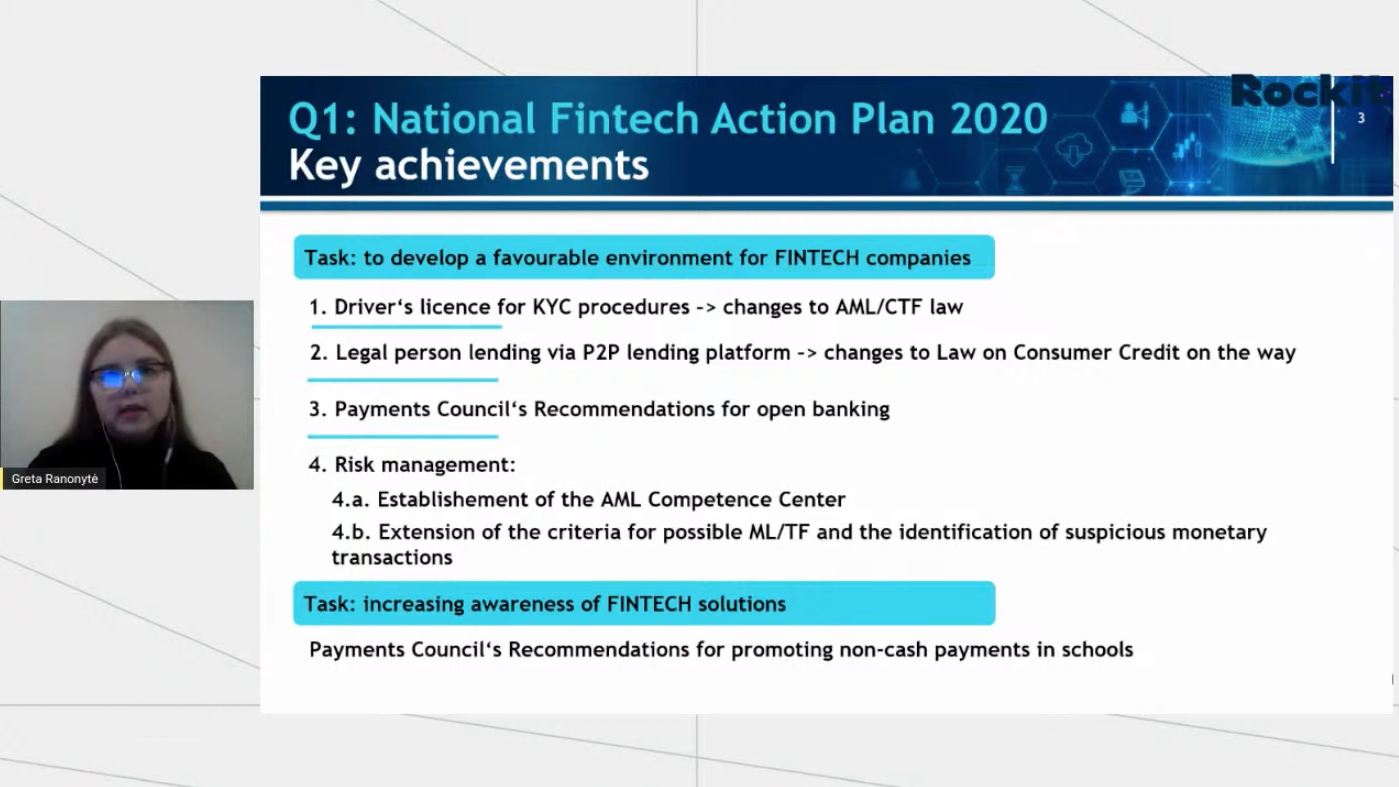

The beginning of the year saw Lithuania formulate its main areas of focus for the National Fintech Action Plan. Fast forward to December 2020, several of these measures have been implemented, Ranonyte from the Lithuanian Ministry of Finance said during the webinar.

On the regulatory front, changes were made to the anti-money laundering and counter-terrorism financing (AML/CFT) law to allow consumers to use their driver’s license for know-your-customer (KYC) purposes. In December, a proposal to change an existing law on consumer credit was brought up in the Parliament. If approved, it would see legal persons being allowed to lend via peer-to-peer (P2P) lending platforms.

The year also saw several changes being made to risk management, with the establishment of the AML Competence Center and the extension of the criteria for possible ML/TF and the identification of suspicious monetary.

Screengrab of Greta Ranonyte, chief strategist of the financial markets, policy department at the Lithuanian Ministry of Finance, presentation for Wrap up of 2020- Fintech Scene in Lithuania, Rockit Vilnius, Youtube

Lithuania launches EUR 6.5 billion DNA of the Future Economy stimulus plan

The plan for the DNA of the Future Economy was approved by the government in June, setting out five priorities; human capital, digital economy and business, innovation and research, economic infrastructure and climate change and energy.

The EUR 6.5 billion stimulus plan, which will run from July 1, 2020 to December 31, 2021, has several measures relevant to the fintech sector including financial and digital literacy initiatives, practical skill development, as well as initiatives to boost the use of artificial intelligence (AI) and data analytics, Ranonyte said.

“Fintech will remain a priority and we will continue to work as hard to ensure favorable conditions for its further growth,” she concluded in her presentation.

Bank of Lithuania’s blockchain moves

2020 saw the Bank of Lithuania moving forward with its blockchain ambitions.

First, in July, the central bank issued LBCoin, a blockchain-based digital collector coin. In an announcement on its website, the Bank of Lithuania said it would release 24,000 digital tokens that commemorate the signing of the nation’s Act of Reinstating Independence in 1918.

And then, at the end of May 2020, the central bank completed the research phase of the LBChain project, an initiative that seeks to develop a platform for companies to carry out blockchain-oriented research, test and adapt blockchain-based services.

LBChain has since moved to the production environment, and the platform is currently being developed by service providers.

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.