Opinion The mobile phone sector has lessons for India’s economy

🔴 Nilesh Shah, Pankaj Tibrewal write: A judicious mix of protection and incentives has helped expand India’s manufacturing base. That model must be expanded to more sectors

The mobile phones and room air conditioners (RAC) sectors in recent times have shown us the formulae for expansion of the manufacturing sector and growing exports. (C R Sasikumar)

The mobile phones and room air conditioners (RAC) sectors in recent times have shown us the formulae for expansion of the manufacturing sector and growing exports. (C R Sasikumar) India and China had similar per capita GDP in 1983. However, Chinese per capita GDP will be five times that of India’s in 2022. Manufacturing and exports have played a significant role in the Chinese economy, transiting it from lower to higher per capita GDP.

The mobile phones and room air conditioners (RAC) sectors in recent times have shown us the formulae for expansion of the manufacturing sector and growing exports.

We were one of the largest consumers of mobile phones in 2014. In 2014-15, our mobile phone imports exceeded $8 billion. Our electronics imports were threatening to exceed our oil imports. The government took many steps like 100 per cent automatic FDI, levy of import duties to protect local manufacturers, the Phased Manufacturing Plan (PMP), manufacturing clusters (EMC 2.0) and the Production Linked Incentive (PLI) scheme. Despite some execution challenges on the ground, these steps have developed our mobile phone manufacturing base. They have attracted investments, created lakhs of jobs, and have moved us from being a net importer to a net exporter.

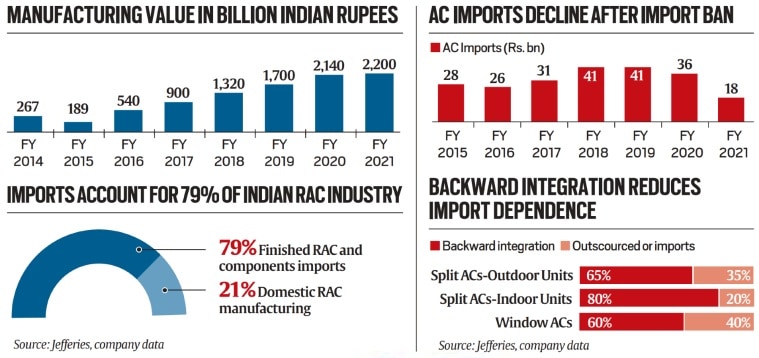

Our mobile phone manufacturing value has jumped more than eight times from Rs 0.27 trillion in 2013-14 to Rs 2.2 trillion in 2020-21. Samsung runs the world’s single-largest location mobile handset manufacturing plant in Uttar Pradesh. We have surpassed the US and South Korea to become the second-largest manufacturer globally.

Source: Jefferies, company data

Source: Jefferies, company data

The next frontier for us is to boost exports and increase value addition. Our mobile phone exports are primarily limited to feature phones and low-value smartphones. India must aim for a significant increase in exports from the current $4 billion. China exports $200 billion, and Vietnam exports $60 billion worth of mobile phones. The PLI scheme aims to achieve the same by allocating incentives of Rs 410 billion for the mobile phone category over the next five years. Global giants like Foxconn, Samsung, Wistron, and domestic companies like Dixon committing investments augurs well for this.

Our value addition in mobile phone manufacturing is currently limited to 15-20 per cent versus more than 40 per cent in China. The scheme for promoting the manufacturing of electronic components and semiconductors (SPECS) is a step in the right direction. Many parts like display panel assembly, camera modules, batteries, chargers, PCB assembly, etc, are being manufactured/proposed to be manufactured in India. This will increase the value-added to the Chinese level over the next few years. We must focus on setting up a fabrication plant to manufacture semiconductor chips to facilitate complete vertical integration. We should leverage our common interests with Taiwan, a global leader in chip manufacturing, for a head start.

The room AC (RAC) sector has performed similarly. We imported RACs worth Rs 41 billion in 2017-18. The government initiated multiple measures such as the PMP scheme, banning the import of refrigerant-filled ACs, increasing the import duty on RACs and critical components, and the PLI scheme. From 2017-18, RAC imports have declined by 56 per cent to Rs 18 billion in 2020-21. Our import of RACs has shifted from China to an FTA country like Thailand, where import duty isn’t applicable.

With the PLI scheme explicitly incentivising component manufacturing, several component manufacturing facilities, especially for compressors, PCBs, motors, etc, are being set up. From importing 79 per cent of RACs, the value addition will move to 60-80 per cent in RACs in a few years.

A judicious mix of protection (levy of import duty/banning of finished goods) and incentives (PMP, PLI scheme, 100 per cent FDI) has developed local manufacturing, created jobs, and turned a trade surplus. Imagine the opportunity to replicate this success across sectors like speciality steel, automobiles, auto components, toys, bulk drugs, technical textiles, food products, solar PV modules, and medical devices.

We missed the manufacturing/export bus in the 1980s. We did excel in services like software to become back office to the world. With China+1 becoming a geopolitical imperative, it is an opportune time for us to expand the manufacturing sector and improve our export market share. Many of our peers are ahead of us in ease of doing business, but none of them has a large domestic market like us. The automobile and generic pharma sector in the past and the mobile phone/RAC sectors recently have shown that we know the formulae.

It will still be a long and arduous journey to attain a stature close to Vietnam or China in exports. To achieve our true potential we need close coordination and seamless working between central, state, and local governments, the rule of law, improvements in infrastructure, especially logistics and flexible labour laws. As India emerges as a credible alternative to China, China will react. From leveraging their financial muscle to cyber-warfare, they will use saam, daam, dand, and bhed to maintain their lead. We need to be adequately prepared.

This column first appeared in the print edition on January 20, 2022 under the title ‘The manufacturing opportunity’. Shah and Tibrewal work at Kotak Mutual Fund. Views are personal.