Many people think when you register a business, you’re all set and can begin selling goods or providing services immediately. But you also need to know which business licences and business permits your new startup might require.

Permits and licences can be different for your business, it’s not possible to provide detailed information about the permits you’ll require, but the following checklist can serve as a helpful guide to get you started.

Virtually all businesses will need a licence of some sort, and many will need to apply for a number of different licences and permits. The types of licences and permits your business requires will depend, among on the type of industry you’re in.

Not all of these licences and permits will be required for your business, however, you will need to do further research into which are applicable to your particular business. Still, here is a list of common regulations, licences, permits and information to assist you further:

Businesses are required to register their business as a Sole Trader, Partnership or Limited Liability Company. It’s important that you register your business. To register your business and get help on how to register your business, click here: Business Registration.

Every business must apply for business tax number and if you are employing staff, you will need to get yourself setup with PAYE (Pay As Your Earn) and other taxes. If you haven’t started with tax information and need help, click here for Tax Registration.

Specific types of businesses or businesses in particular industries may require special professional or occupational licences. For example, child care businesses must obtain a special licence. Professions such as lawyers and accountants are also often regulated and may require special professional licences.

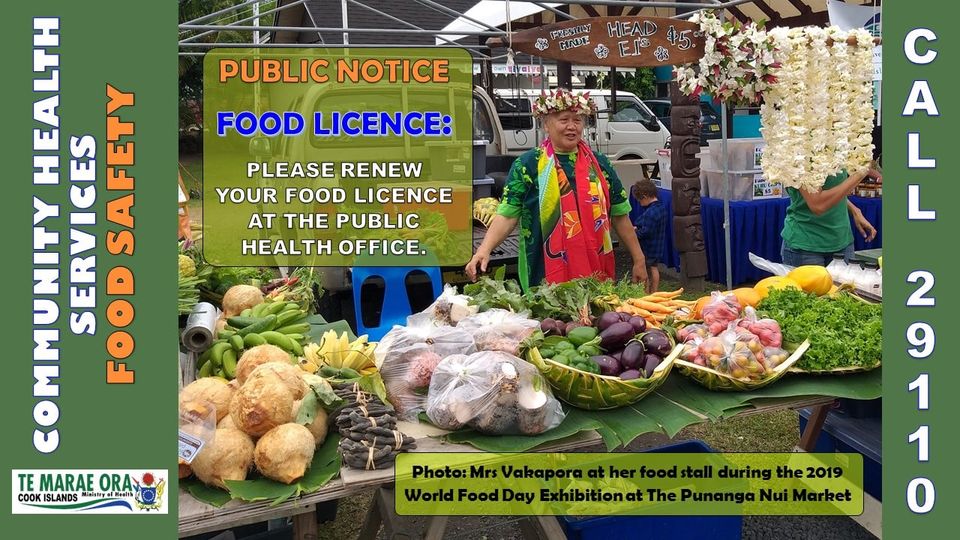

Certain businesses such as those which involve the preparation and handling of food must require a food permit. The importation, supply and sale of food is legislated through the Food Act 1992-1993. Any person or establishment selling, producing or supplying food is required to obtain a food licence. The Public Health directorate are required to protect the health and wellbeing of consumers and set and monitor food standards. All food handlers selling food to the public are required to apply for an annual food licence from the Public Health office. An application for a food licence will require food handlers to obtain a medical certificate from a clinician at Te Marae Ora and undertake a written test on food safety. Click here to download an annual food licence: Download the annual Food Licencing application form. It is also important to be familiar with the Food Regulations 2014. It includes the food standards, importation of food, food safety and hygiene, marketing of food and offences against these regulations. Click here for the Food Regulations Guide: Food-Regulations-2014.

Click here to Ministry of Health’s website: Ministry of Health

If you are building, you will require a building permit for your new business. There are building rules and regulations. The first place to check is the National Environment Service for environmental requirements (if any). Click here for their website. You may also want to check out Infrastructure Cook Islands Building Regulations as well. You will find building application permits and other useful information to help you get started. Click here for ICI’s website details and building regulations.

If you are interested in employing people from from overseas, they must apply for a work permit with the Ministry of Foreign Affairs and Immigration. This involves completing a health clearance check/certification and a police clearance check/certification before travelling to the Cook Islands. Persons entering the Cook Islands to take up employment must hold relevant skills and qualifications for the vacant position applied for, and must also satisfy health and character requirements. There is also provision for people who wish to invest in business and live in the Cook Islands. See Foreign Direct Investor Regulations below.

To facilitate the processing and entry of a foreign worker for work purposes, the sponsor as the employer is responsible for arranging and ensuring that the applicant meets the entry and work requirements in the Cook Islands.

For more information regarding immigration laws and regulations, you can contact the Ministry of Foreign Affairs and Immigration (MFAI) directly by email – immigration2@cookislands.gov.ck. Click here to Ministry of Immigration website.

Employing workers / staff for employment with the right information and understanding, is important. Recruitment is a key step to ensure that your business continues to be successful. Ministry of Internal Affairs has a wealth of information to help you with labour and consumer services including starting employment, during employment, ending employment as well as fair and decent workplace practices. Here is a good place to start – Labour & Employment Relations. Furthermore, all Employers should follow and respect the minimum terms and conditions as required by the law. It’s important that you familiarize yourself with the Employers Relations Act 2012.

If you are Cook Islands resident (indigenous | permanent) interested in partnering with a foreign business partner or an investor including foreign corporations, partnerships and trusts, you must contact Business Trade & Investment Board Foreign Enterprise team. You must register the foreigners’ interest in the Company. This includes shareholding interests, control of shares and your involvement in the management and control of the business. For Foreign Direct Investment, click here for details, forms and applications.

A licence or permit may be required if your business is involved in taxi services, rental or passenger service. The licencing of transport services are administered through the Ministry of Transport. Click here for Land Transport Website details.

This checklist is a guide only however, you may need to do further research on the licences and permits relevant to your business.

Any sale or supply of liquor in public places requires a licence as stated in the Sale of Liquor Act 1991-1992. The Act sets out the requirements and criteria the Liquor Licencing Authority consider when granting liquor licences. In many cases these licences serve to show that the business in question has met specific liquor-regulated standards.

Liquor Licence is issued to a named person, company or organization and cannot be transferred. There are different types of licences as identified in Part II of the Act, and these include:

Unless specifically indicated, the licence authorizes the holder to sell or supply alcohol on the premises only. Liquor cannot be removed from these premises. There can be various conditions that apply to each licence.

There are a number of application forms that you will be required to fill in.

See below to Apply for a Licence.

This information sheet will help you with the steps required to obtain a licence for the first time.

This information sheet will help you with the steps required to renewal of a liquor licence.

This information sheet will help you with the steps required to renewal of a Manager’s certificate.

If you are holding an event where alcohol will be provided and people attending pay for the alcohol

by either purchasing from a bar, by a ticket system or cost of the alcohol is included in pre-paid

tickets, then you are considered to be selling alcohol, therefore you are required to hold a Special

Licence.

This information sheet will help you with the steps required to obtain a ‘Special Licence’.

Business Trade Investment Board

Opposite the Punanga Nui Market

Ruatonga

Avarua Rarotonga

Cook Islands

Telephone: +682 242 96

Fax: +682 24 298

Private Bag, Rarotonga, Cook Islands.

Email: btib@cookislands.gov.ck

Monday – Friday

8am – 4pm

Closed: Saturday and Sunday

Statutory Holidays