US tech companies are pulling back on office leases, another sign of how economic uncertainty is pushing once high-flying firms to rein in their spending.

The tech industry’s share of leasing activity, or the total square footage of leases signed, has dropped this year. It now accounts for about 17% of office leases in the US, compared with 21% last year, according to data from CBRE, a commercial real estate firm.

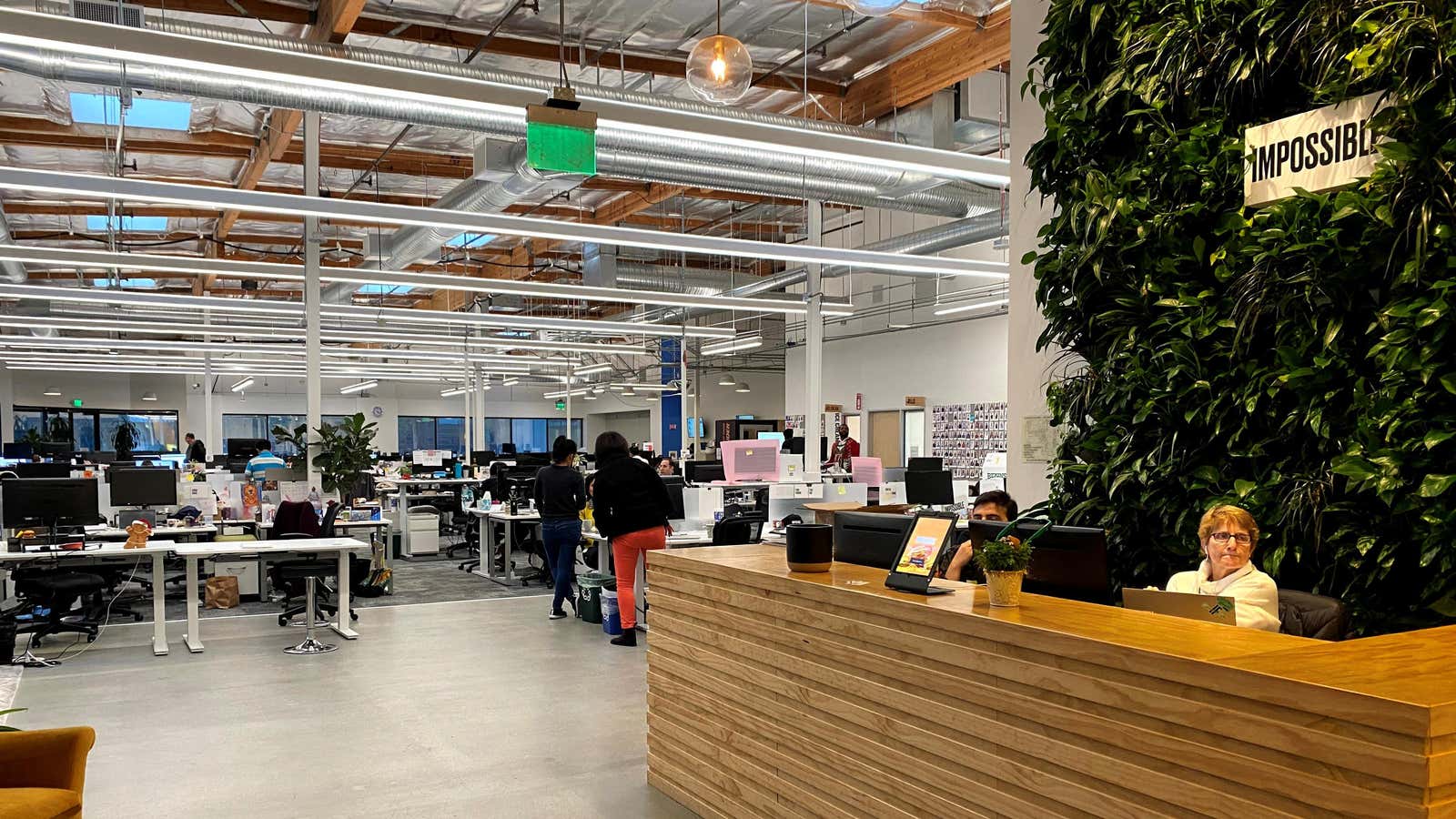

With its sprawling campuses and large workforces, the tech industry had until recently taken up the biggest share of US office real estate. During the pandemic, companies like Amazon and Google hired lots of workers—and spent billions building out new offices.

But as those office expansion plans get reversed, the finance and professional and business services sectors are eclipsing tech’s share of office real estate.

Work-from-home means tech companies need less office space

Tech employers have been reducing office space since the beginning of the year due to remote work and hybrid policies, said Colin Yasukochi, the executive managing director of CBRE’s tech insights.

The economic slowdown is exacerbating that trend. Along with laying off workers, the pullback back on office leases is part of cost-cutting measures tech companies are taking.

That doesn’t mean Silicon Valley, home to the biggest tech companies in the world, is going away anytime soon. “There’ll be a greater focus on software development and innovation in the Bay Area and maybe a little bit less focus on some of the supporting roles that could be performed in other markets,” he said.